MUTUAL FUNDS - FAQS

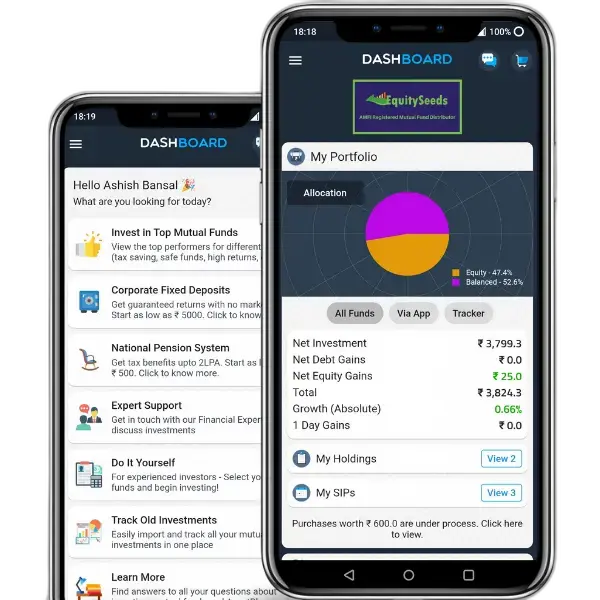

Start Your Investment Journey Today!

Install the app and get your account approved in 2 minutes.

FAQS 1:

A Mutual Fund investment is just like a Fixed Deposit or Post Office Term Deposit. Let us assume you are an investor who does not have experience in managing money and taking investment decisions, but you are looking for better returns. You need professional help to manage your money and receive good returns. So all you need to do is invest in Mutual Funds. If you invest in Mutual Funds on a monthly basis it is called SIP (Systematic Investment Plan).

A Mutual Fund starts by collecting money from investors. Let us say 10000 investors have each invested Rs. 10000 in the fund. So the total amount collected is Rs. 10 crores. This amount is then managed by a professional fund manager who invests it by purchasing shares and bonds depending on the type of Mutual Fund. The profits from the investments are shared by all the investors.

The major benefits of a mutual fund are –

1. Expert Money Management

Many investors might not have the time or knowledge to invest in stock markets. A professional fund manager from the mutual fund company will have better knowledge of how to invest the money for best returns.

2. Easy Investment Process

One can start investing in any Mutual Fund in less than few minutes without the need of any paperwork. All the transactions can be done online as well.

3. Liquidity

Most Mutual Funds can be redeemed anytime and the investor will receive the amount in his bank account within few days. There is no lock in period like in Insurance and Post Office Deposits. This makes sure that the money is available in case of emergencies.

4. Wide variety of options

There are different types of Mutual Funds available to suit any investor. Safe funds (Debt funds) meant for short term to High Risk funds for long term, and Tax Saving (ELSS) funds. Investor can choose from any of the funds depending on his needs.

When an investor buys a Mutual Fund, they are provided with units. The cost price for each unit is called NAV (or Net Asset Value). For example, if you have purchased a Mutual Fund for Rs. 10000 at a price (NAV) of 100, then you will receive 100 units. One year later, the shares invested by the mutual funds have increased in value so the NAV increases to say 105. You can now sell your units at NAV of 105 for a total value of 100 x 105 = Rs. 10500. So your profit is Rs. 500.

Overall, Mutual Funds are one of the best investment options for any type of investor. If you are not investing, don’t delay any further and start investing today!

An SIP is a smart and easy way to invest in Mutual Funds. SIP allows you to invest a fixed amount on a monthly basis. It is a planned approach towards investments that helps you develop a discipline of regular investing and create more wealth over the long term. It as similar to EMI where you pay monthly instalments to the bank. The difference is that in an SIP you invest the money on a monthly basis for your goals.

Let us check how an SIP works with an example. Say you are starting an SIP of Rs. 1000 in a Mutual Fund on 1st date. Then on 1st of every month Rs. 1000 will be auto-debited from your bank account and invested in the fund.

For every instalment, you will receive units of the fund that is added to your account. These units are purchased at different NAVs depending upon the NAV on the 1st of every month.

Hence, investors starting an SIP benefit from both compounding and lesser risk.

Compounding refers to a simple rule – the sooner you begin investing, the more your money grows with time. Let us understand this with an example.

Kishore started investing Rs. 5000 in SIP at the age of 30. He planned to invest till his retirement at 60. Assuming returns of 15% per year, by the age of 60 Kishore will have total amount of 3.5 crores.

Ramesh started investing Rs. 10000 in SIP at the age of 40. Assuming the same returns and retirement age, he will have an amount of 1.5 crores.

Even though Kishore is investing a smaller amount every month he has created more than twice of Ramesh’s wealth by starting early.

1. Disciplined investing

SIPs ensure that you invest regularly and helps you develop the habit of investing. Disciplined investing is one of the first steps towards attaining your financial goals.

2. Convenience

SIP is an easy way to invest in Mutual Funds. You just need to complete a one time online registration with your bank to start an SIP.

3. Wealth Creation

When you invest in an SIP over long term, you can accumulate significant wealth. An SIP of Rs. 1000 for 20 years can provide more than Rs. 25 lakhs.

4. Flexibility

SIPs do not have any lock-in period, which means you can cancel or redeem the investments anytime. You can also increase or decrease the SIP amount and duration.

Investing in an SIP has proven to be one of the best ways to create wealth for an investor. Start an SIP today!

Fixed Deposits (FDs) are one of the most common investment options in India. An FD provides between 7 – 8% annual interest on the invested amount. The advantage of an FD is that the returns are assured and there is no market risk. Let us compare the returns between an FD and an Equity Mutual Fund by assuming you have invested Rs. 100000 in each in 2008.

From the above graph, we can see that in 10 years, MF investment has increased to Rs. 360000 whereas the Fixed Deposit investment has become Rs. 200000. Although the returns are not guaranteed, Mutual Funds deliver much higher returns over the long term.

It is also important to note that the cost of School Education has become 2.5 times in the last 10 years!

So when should one invest in an FD? When he wishes to invest for short term and without risk (Debt funds can also be considered for this and provide higher returns than a FD). For any long term financial goals, FDs are not the best investment option.

Many of us would have heard of LIC as an investment option from friends, relatives or an LIC agent. Firstly, it should be noted that LIC is not an investment. Some amount that you pay as monthly premium is utilized for “Insurance” and the rest is invested. So the actual amount invested is lesser than the premium you pay. LIC invests this money in stocks and bonds to provide returns to the investor. Let us analyze the returns provided by one of the most popular LIC policies – Jeevan Anand.

Assumptions

Starting age – 25, Policy Term – 35 years, Sum Assured – Rs. 10 lakhs, Yearly premium payable – Rs. 28000

Your total investment over 35 years would be 28000 x 35 = Rs. 980000

On maturity, the total amount (Sum Assured + Bonus) received is Rs. 51 lakhs. This comes out to be less than 7% annual returns. If the same amount was invested as an SIP in an Equity Mutual Fund for 35 years, the maturity amount would have been almost 2.5 crores!

Hence, it is advisable to never mix Insurance and Investment. You can purchase insurance in the form of a Term Insurance Plan, and invest the rest of the amount in Fixed Deposits or Mutual Funds.

Many investors are comfortable with investing in Real Estate. We believe it has less risk since there is always a demand for real estate. We have also heard of thousands of people doubling or tripling their money by purchasing property. For example, if someone had purchased property in Mumbai for 10 lakhs in 2000 it would be worth around 75 lakhs in 2018. That is a 7.5 times increase in 18 years!

Year | Investment Value (Property) | Investment Value (Mutual Fund) |

2000 | 10,00,000 | 10,00,000 |

2005 | 20,55,000 | 22,80,000 |

2010 | 3762,000 | 86,30,750 |

2015 | 56,75,000 | 1,63,10,000 |

2018 | 74,98,000 | 1,89,32,000 |

Let us check what is the annual return rate for the above investment. After calculation, we see that the returns for the property comes out to be 11.8%.

Most Mutual Funds have provided between 15 – 20% returns during the same period. Which means if the same 10 lakhs was in invested in a good Mutual Fund in 2000, it would have become 1.9 crores by 2018!

Moreover, investment in Real Estate requires a huge surplus whereas you can start investing in Mutual Funds with as little as Rs. 100. So unless you are looking to purchase a property for personal use or as a home to live, do not take a home loan and invest in Real Estate. As an investment option, Mutual Funds tend to perform better than Real Estate over long term.

Different types of Mutual Funds have different risk levels, starting from very safe investments to highly risky investments. The risk in Mutual Funds can be selected by the investors as per their needs.

There are Mutual Funds which are nearly as safe as Fixed Deposits called Debt Mutual Funds. Investors who do not want any stock market risk can invest in these. Since the risk in such funds are very low, the returns are also nominal. Investors can expect maximum of 8 – 9% returns in such funds.

There are Mutual Funds which have higher risk, but also provide higher returns, called Equity Mutual Funds. These are meant only for long term investments (more than 3 – 5 years). We explain more about this below.

Unlike in a Fixed Deposit or a Term Deposit, in a Mutual Fund the returns are not fixed. Since the returns are going to be different every year, we say that these Mutual Funds have some risk. Let us understand this with an example.

Say you have invested Rs. 1 Lakh each in a Mutual Fund and a Fixed Deposit (Interest rate – 7% after tax) in 2010. The actual investment value at the end of every year is shown below.

Year | Annual Returns (Fixed Deposit) | Investment Value (Fixed Deposit) | Annual Returns (Mutual Fund) | Investment Value (Mutual Fund) |

2011 | 7% | 1,07,000 | -20.13% | 79,870 |

2012 | 7% | 1,14,490 | 28.7% | 1,02,792 |

2013 | 7% | 1,22,500 | 11.98% | 1,15,127 |

2014 | 7% | 1,31,080 | 52.5% | 1,75,569 |

2015 | 7% | 1,40,255 | -4.28% | 1,68,054 |

2016 | 7% | 1,50,073 | 7.65% | 1,80,910 |

2017 | 7% | 1,60,578 | 37.25% | 2,48,298 |

By the end of 7 years, profits from Mutual fund is Rs. 148298 while profits from the Fixed Deposit is Rs. 60578. But we can see that while Fixed Deposit gave constant returns, the Mutual Fund provided different returns every year. In 2011, the Mutual Fund gave a loss of 20.13% !!

This is known as the risk for any Mutual Fund. The risk simply means that the returns are not fixed and can vary every year. Every investor should understand that the returns provided by Mutual Funds are dependent on many political, geographical and economical factors. It is also possible to have a loss in the short term (less than 2 – 3 years). But over the long term, Mutual Funds have always provided significantly higher returns than Fixed Deposits and created more wealth. In the above example, average annual returns of the fund is 13.85% compared to 7% of Fixed Deposit. The Mutual Fund has given 2.5 times the returns given by the Fixed Deposit!

This means that an investor who understands the above risk and invests confidently for the long term can create huge wealth from Mutual Funds. It is also important to note than investors who do not want any risk can always invest in Debt Mutual Funds which have zero market risk and can provide more returns than a Fixed Deposit (and they also don’t have any lock in period or penalty for withdrawal).

Liquid funds only in invest in Fixed Deposits and Bonds that have a maturity of upto 91 days. They are useful for investors looking to park idle funds from the Bank accounts without risk, since most Savings Accounts only provide 3.5 – 4% interest.

Returns – 6.5 to 7.5%

Risk – No market risk

Duration of investment – Up to 6 months

Withdrawal – 1 working day, no charges

Debt funds invest in Government, Corporate Bonds and Bank Deposits. These are relatively safer investments as they do not invest in shares. They are a good alternative to Fixed Deposits.

Returns – 7.5 to 8%

Risk – No market risk

Duration of investment – More than 6 months

Withdrawal – 1 working day, no charges

These funds mostly invest in shares of companies and are best useful for wealth creation. The risk is high during the short term, so one should invest in Equity funds only for the long term.

Returns – 12 to 15% over long term

Risk – Moderate to High risk

Duration of investment – More than 3 to 5 years

Withdrawal – 3 working days, 1% penalty before 1 year

Returns – 7.5 to 8%

Risk – No market risk

Duration of investment – More than 6 months

Withdrawal – 1 working day, no charges

Hybrid Funds invest both in Equity and Debt. So they offer a mix of wealth creation with lesser risk.

Returns – 10 to 12% over long term

Risk – Moderate Risk

Duration of investment – More than 3 years

Withdrawal – 3 working days, 1% penalty before 1 year

If you have read about Mutual Funds and are not sure how to proceed, you can start with just Rs. 100 in Reliance Liquid Fund!

- This fund is one of the safest Mutual funds and has zero market risk

- It only invests in government bonds and deposits (no stock market/equity risk)

- You can invest and withdraw anytime without charges or exit load

- After you have made the investment, you will receive allotment SMS and email confirmation from Reliance in 2 working days

- After allotment, you can check the latest value of the investment everyday on AssetPlus

Mutual Funds are the favourite option among investors who are planning to achieve their financial goals. They are suitable for both short-term goals (Eg: Vacation, Mobile Phone) and for long-term goals (Eg: Children’s Marriage, Retirement). Here are a few examples of our investors’ financial goals.

Pradeep (37), Investing to buy a New House

Pradeep is a 37-year-old Private Sector employee working in Mumbai. He had been investing Rs. 40000 a month in Fixed Deposits which gave him 7.5% annual returns. His financial goals were – Purchase of a house, Children’s Marriage, and Retirement. He soon realized that Fixed Deposits provide low returns and it would not be possible for him to achieve his financial goals. One of his friends recommended Mutual Funds, but Pradeep was unaware of how to proceed.

He contacted one of the advisors from EquitySeeds who had a detailed discussion to understand Pradeep’s financial requirements and risk-taking ability. Based on this information and considering the market conditions, Pradeep was recommended a set of Equity and Debt Mutual Funds for investments. Pradeep began investing and has had portfolio returns of 18.3% in the last 2 years. He is not worried about the market risk since our advisor is available to help him manage his investments at any point, and is on the right track to purchase his own house within the next 2 years.

Gopal (57), Planning his Retirement

Gopal is a retired professional from Bathinda, Punjab. On retirement, he had received a corpus of about Rs. 50 Lakhs as part of his PF settlement. He planned to invest the amount to receive a monthly income which will be used for medical expenses, house rent, and other day-to-day expenses. At that time, Fixed Deposits were providing 5.5% returns after tax which was almost the inflation rate. He wanted to invest in Mutual Funds but was not sure about where he should invest and how he can optimize his Income Tax. He was also worried about risk since the amount was large.

He reached out to EquitySeeds and was provided a dedicated financial advisor. After an elaborate discussion, the advisor was able to recommend a portfolio with a mix of Liquid, Debt and Equity Mutual Funds with Systematic Withdrawal Plans (SWP) to handle monthly expenses. The advisor also ensured that Gopal saved on tax as much as possible. Gopal has had returns of 9.7% since he began investing, with low exposure to Equity funds.

Namita (30), Saving Income Tax

Namita is a 30-year-old working in an IT company as a Software Engineer. In the month of April ‘17, her office had sent her an email about tax saving and she had declared Rs. 1,50,000 of investments under Section 80C for the Financial Year 17-18. It was only in February ‘18 she realized that she had not made any tax saving investments. The deadline to submit the proofs was 2 weeks away and if she did not submit, she can lose up to Rs. 40000 in tax.

She came across EquitySeeds and mentioned that she was looking for assistance with tax saving investments. One of our advisors reached out to Namita and assisted her with the entire process right from explaining the basic investment options to calculating exactly how much she needed to invest. The advisor provided her with a portfolio of Tax Saving funds she can invest in and sent the required proofs within a day of making the investments. The advisor was also able to plan her taxes more efficiently for the next financial year.

Amit (32), Investing for Children’s Education

Amit is a 32-year-old Private Sector employee from Durgapur. He has 2 children and his elder son had just started school. Amit was shocked by the fee charged by schools these days. His own 12 years of school education had cost around Rs. 25,000 but he was paying Rs. 30,000 per year just for his elder son’s education in a private school. He realized the importance of planning for his financial goals and wanted to start investing for his children’s education.

His friend referred him to EquitySeeds, and he approached us to plan his investments. One of our senior advisors contacted Amit to understand his exact requirements. He explained the concept of Inflation and how prices of food, education, and other necessities increase at a much higher rate than we expect. The advisor also helped him calculate how much he should invest every month and explained the risks associated with Mutual Funds. Amit was then advised a portfolio consisting of Liquid and Equity funds.

Amit has been investing for almost 1.5 years and has already accumulated funds for his younger son’s school admission. He also takes the help of the advisor to review his investments every year and makes sure he is on the right track to achieve his goals.

Anubhav (25), Investing for his Marriage

Anubhav is a 25-year-old Government employee working in Patna and earns Rs. 25000 per month. He wanted to save Rs. 3000 every month (SIP or monthly investment plan) for 3 years for his marriage expenses. He started investing in 2015 and was not aware of the market risk and fund selection. He started investing in a Small & Mid Cap Mutual Fund because it gave 70% returns in 2014 but he did not check the risk.

The markets had performed poorly in November and December 2016 and due to this Anubhav had a loss of 20% after investing for one year. He was worried about his investments, and on searching about Mutual Fund advisors he came across EquitySeeds. His advisor was able to help him understand why his fund selection was not suitable for his portfolio since it was a long-term fund. As per the advisor’s recommendations, Anubhav stopped his high-risk SIP and began investing in a Balanced fund which was more suitable for his goal.

With the advisor’s guidance, he currently has a corpus of Rs. 1,10,000 after 2.5 years of investing (16.5% annual returns even after the market provided loss in between) and is confident of achieving his financial goal in the next 6 months. He has also started new SIPs to have a corpus of Rs. 1 crore by retirement.

When you have clear investment goals, it becomes much easier to plan your investments. All factors such as investment amount, risk and investment duration can be calculated and based on this you can select suitable funds for investments. A goal can be as simple as Wealth Creation or Retirement. Examples of few goals are – I need 1 crore by 2035, I need 20 lakhs for my daughter’s marriage by 2030, etc.

If you do not have any goal, then you will end up taking too much risk in your investments and will eventually face a loss. But once a goal has been decided, it also gives you an idea of how much risk you can take. For example, you should take lesser risk while investing to buy a house as compared to investing for your retirement (which is a longer term goal). You can also calculate how much you need to invest to achieve the goal, and select suitable funds accordingly.

Once you invest for a goal, it becomes easier to keep track of the performance of your funds and whether or not you are on the right track to achieve your goal. You can plan further and make changes accordingly.

The next step involves three processes – Planning, Investing and Reviewing.

Planning include listing your goals, deciding how much amount is required for each goal and estimating the time left to achieve the goal. Once this has been done, you can calculate how much amount you need to invest and what kind of investments are suitable for the goal.

For example – you need 10 lakhs for your son’s education in the next 5 years and can afford to invest Rs. 10000 in SIP. Since the duration of the goal is medium term (5 years), you should not invest in very high risk funds and instead invest in moderate risk funds.

Once the suitable funds have been selected and planning is completed, the next step is to begin making the investments. It is not sufficient to start investing in the same funds and continue till end of goal. You should also monitor the performance on a regular basis depending on the market conditions to ensure that you are on the right track or if you should invest more.

If you need help with deciding goals or which funds are the best for your goals, our advisors are available to help you anytime!

In our latest update, you can add any number of goals and link your Mutual Funds to particular goals to keep track of the progress. Make sure you link all your investments to relevant goals!

Since the end of January, the Indian stock market has moved down sharply due to various economic and political factors. Due to this, all Equity Mutual Funds and in particular – Small & Mid cap funds have moved down by 10 – 20%.

It is important to understand the fact that – This is very common for Equity Mutual funds and Stock market!

During an average year, Equity Mutual funds can easily lose 10 – 20% of their value (like in 2011, 2016, 2018). If the markets perform very poor they can even lose up to 50% (like in 1993, 2000 and 2008). It is not possible to predict such crashes.

As long as the following conditions apply to you, you have no reason to worry.

- You are investing for the long term (at least 3 years. Preferably more than 5 years)

- You have invested as per your financial goals and risk profile

If you do not satisfy either of the above, you can contact us so that our advisors can recommend a portfolio that is better suitable for you.

If both the conditions apply to you, then it is better you follow the “invest and forget” approach, and allow the market to recover gradually in the future. In fact, since most Equity Funds are available at a lower price, many of our experienced investors have invested huge lump sums in the last few weeks to purchase more units! When markets recover over, such purchases can provide tremendous returns.

To conclude, such market downfalls are completely normal and you need not worry. If you have spare funds, you should consider investing more now. Else you can just hold on to your investments and they would recover. Remember that, the most harmful thing to do at this point will be to stop your SIPs or Redeem your investments because not only will you have a permanent loss, you will also be losing out on future profits.