VIX is a real-time market index that calculates the market’s expectation of 30-day forward-looking volatility.

Since, VIX has a direct impact on the IV of an option it is an important indicator of when to buy option (as a strategy) and when to sell option (as a strategy).

As a general thumb rule while trading in options using VIX:

1. When VIX is going up-

- It is an indication of IVs going up too and hence options trading would get risky for an option buyer. Since, they would be paying higher premiums to buy an option.

- But, an option seller can benefit from higher IVs as they may get more premium on selling options.

2. When VIX is going down-

- In this scenario, an option buyer can trade in options by paying a lower premium and hence the risk to capital is reduced on same position sizing.

- On the other hand, an option seller is receiving lower premium on selling options which affects their profitability.

How VIX can also be interpretated in a different way?

1. As VIX denotes volatility in stock market.

- Higher VIX = Higher Volatility = Higher price range in market swings.

- Lower VIX = Lower Volatility = Shorter price range in market swings.

2. Option traders preference of volatility.

- Options buyers like trading in higher volatility as the higher volatility means higher profit making opportunity.

- And, option sellers like lower volatility as adjusting positions in lower volatility in comparatively easier.

3. Risk and reward preference.

- Options buyers are comparatively higher risk takers and hence although they pay higher premium on option buying, like the higher VIX.

Option Buyer = Prefer Higher VIX = For High Profits = Against High Risk

- While, option sellers are conservative in risk taking and are happy in a lower profits but prefer low volatile markets.

Option Seller = Prefer Lower VIX = For Low Profits = Against Low Risk

In Stock Market, its important to learn, backtest and implement new strategies and even make mistakes initially, but once you find a strategy that helps you create money with peace of mind, you should continue doing that same thing again and again.

Ashish Bansal

CEO, Founder

How to know VIX is high or low?

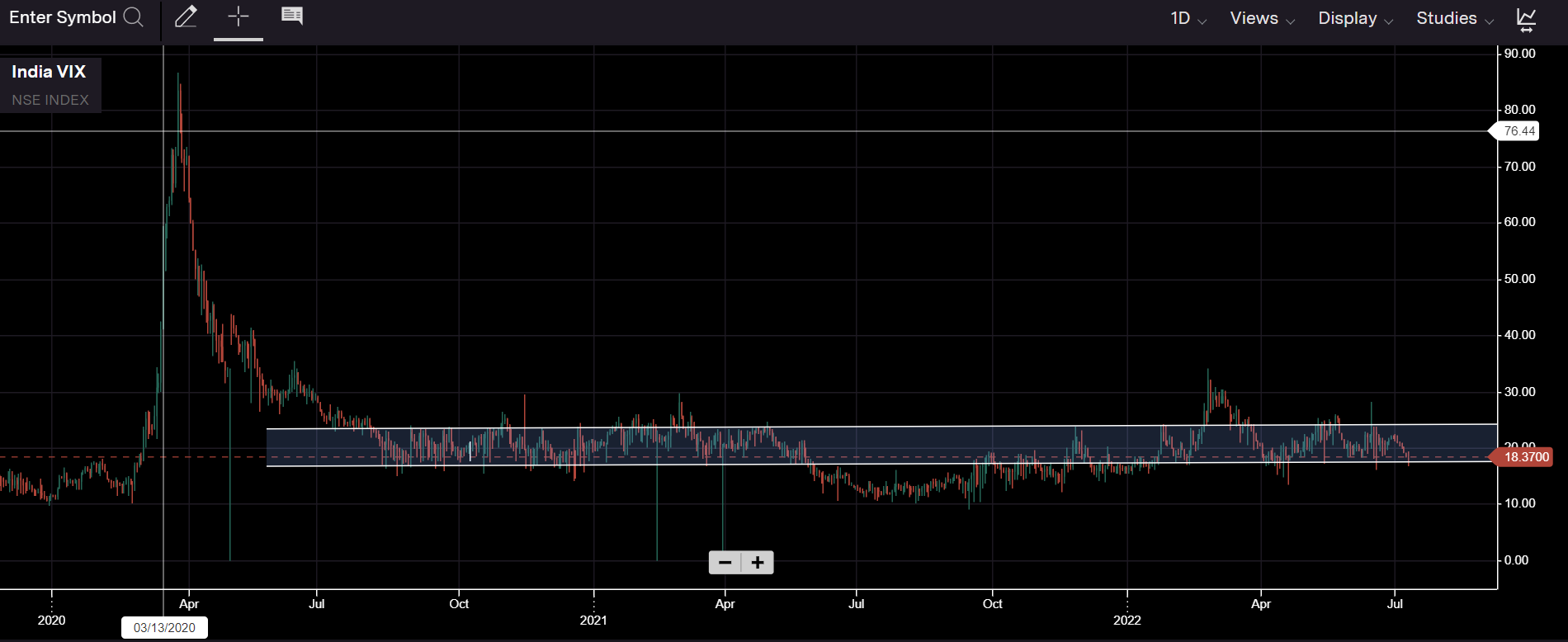

As a general market interpretation or as historical data shows:

- VIX below 18 is low.

- VIX in the range of 18 to 24 is normal.

- VIX above 24 is high.

Always have a trading plan-

Most trader fail at trading in stock market due to lack of planning.

“A Trading Plan helps you in managing the losses in the worst cases scenarios which is more important than returns you make.”

Ashish Bansal

CEO, Founder